Risk Differentiation Underwriting (RDU)

Exempt your affluent clients from the law of large numbers

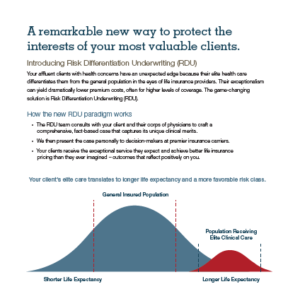

In the classic life insurance paradigm, your special-risk clients were typecast by standard actuarial tables even when their sophisticated clinical care should have favorably differentiated them from the norm. Now you can break free of that model, facilitated by a game-changing strategy called Risk Differentiation Underwriting™ (RDU).

We work directly with you, your client and your client’s physicians to separate their individual risk from an otherwise statistical/actuarial group. This strategy allows you to achieve favorable life insurance coverage levels and premiums that others simply cannot. In the process, you distinguish yourself as a provider of intensely personal service that can enhance long-term client relationships.

savings

amount

amount

Even your most discerning clients will be impressed with the results.

It’s a powerful moment when you

can say to your client, “you are not a statistic.”

Start early so our RDU experts can consult with your client and their physicians to assess and understand the client’s unique circumstances.

Our 25+ years of experience in RDU lets us know which carriers to approach to negotiate the most favorable premium while reducing time-to-approval.

Download our RDU brochure now!

Spotlight

Meet our RDU expert.

How we determine if RDU is

appropriate for your client.

1.

Understand the Medical Challenges

At the earliest point, we triage and analyze the unique characteristics of your client’s medical history to determine if the case can benefit.

2.

Engage the Client and their Corps of Physicians

We explain the gaps between insurance medicine and clinical medicine with all stakeholders to achieve client buy-in and gain access to the extensive information this strategy requires.

3.

Determine Premium Tolerance

Up front, we discuss what premium costs will be acceptable to the client and advisor. The minimum annual premium to initiate RDU is typically $25,000.

4.

Explain the Timing

We will explain the sequence of events so the client understands how they can favorably impact the underwriting result and the eventual premium.

The RDU Difference

The primary goal of Risk Differentiation Underwriting is to “always do the good and right thing” and to recognize that “the client always comes first.” Advisors bring our team of experts to the table to talk with their clients about the most personal and intimate details of their lives —their health and their mortality. We do not accept what is immediately apparent as final—rather, we dig deeper and go beyond the APS—for you and your client.

“It sounded too good to work. But it really did”

CASE STUDY

BSMG’s RDU delivers extraordinary life insurance results for your clients

A 70-year-old woman was declined $1.25M in UL coverage due to multiple falls that indicated possible neurological impairment.

RDU was used to differentiate the causes of her falls to reinstate eligibility. RDU found that her falls were due to other, less serious factors.

Client was approved as a preferred non-smoker and was able to double the face amount to $2.5M.